How to Secure Your Future: A Financial Roadmap for New Earners – By Aakarsh Dalmia, CFP®

Congratulations on your first paycheck! But Hold On, What about your first investment? If you’re thinking, "I have plenty of time to worry about saving and investing later," think again. Your financial security starts now, not in your 30s or 40s. Ignoring key financial steps in your early years can set you up for struggle down the road. Wealth doesn’t happen by accident; it’s the result of thoughtful planning, disciplined investment, and regular monitoring. The longer you wait, the harder it becomes to catch up.

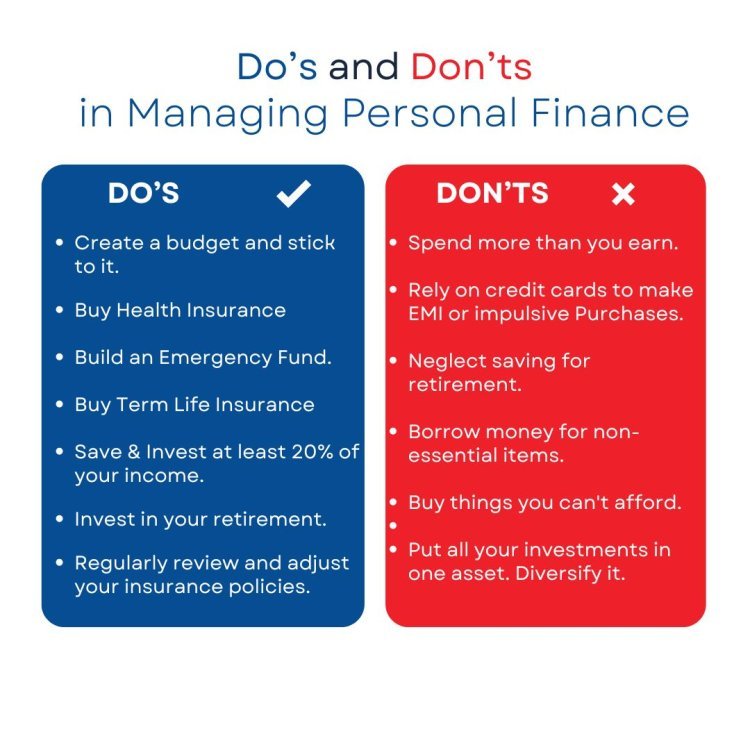

So, where do you start? Let’s break down the essential steps every new earner should take right now to avoid falling into the paycheck-to-paycheck trap and set themselves on the path to financial independence.

Step 1: Buy Health Insurance—Now! Be it your first step to financial stability

Even if you've joined the organized sector and your employer provides group health insurance, don’t rely solely on it. Group policies often have limitations in coverage and may not be portable if you switch jobs or leave the company. To truly safeguard your health and finances, consider buying an individual health insurance policy in addition to your group coverage.

Why it matters: Healthcare costs are skyrocketing, and a single serious illness or accident can derail your financial future. Having a personal health insurance policy alongside your employer’s plan adds an extra layer of protection, ensuring your financial plans won’t collapse overnight due to medical expenses.

Action Plan: Consider buying a policy with coverage of at least ₹10 lakhs with a premium outflow of Rs 10K approx. Look for a plan that includes hospitalization, no room rent capping, a restoration facility (which replenishes the sum insured if exhausted), coverage for day-care procedures, and no sub-limits on treatments.

Step 2: Build an Emergency Fund Before Anything Else

Many new earners rush into investing without setting aside an emergency fund. That’s a mistake. Life is unpredictable, and you’ll likely face unexpected expenses or spends like auto repairs, job loss, family support, health emergencies, or sudden travel. Without an emergency fund, you’ll be forced to rely on credit cards or loans, plunging you into debt.

Action Plan: Aim to invest 20%-30% of your monthly income to build this fund over time, equaling 6-12 months’ worth of living expenses (non-discretionary expenses). Store this money in a bank fixed deposit or short-term debt schemes of mutual funds. Automate transfers into this fund every month to ensure consistency.

Step 3: Buy Adequate Term Life Insurance – To Safeguard your Family

If you have dependents—whether parents or a spouse—getting life insurance coverage is a must. Term life insurance is affordable and ensures that your loved ones won’t suffer financially if something happens to you. It’s about protecting the people you care for.

Action Plan: Your term life coverage should be at least 15-20 times your annual income. Choose a policy with a high claim settlement ratio and excellent customer support. It doesn’t cost a ton, but it gives you peace, which is very important.

Step 4: Start Investing for Building Wealth Corpus

Time is your most valuable asset when it comes to investing. The earlier you start, the more time your money has to grow. Waiting even a few years could mean losing out on potential wealth that could’ve been easy to accumulate with consistent investments. Asset Allocation is the most important part of investing, use it to diversify your investments for risk mitigation.

You don’t need a large amount to start investing. Systematic Investment Plan (SIP) in mutual funds allow you to invest small amounts ( as low as Rs 500/- ) every month. Over time, these small amounts can grow significantly thanks to compound interest.

Fact: Starting at 25 instead of 30 could mean an extra compounding effect, potentially doubling your corpus by the time you retire. Compound interest rewards early starters.

Action Plan: Begin investing with 20% of your monthly income, and top it up with any extra incentives or bonuses. Increase your investment amount each year to build your wealth more effectively. Automate your investment.

The Bottom Line: Your Future Starts Now

The financial habits you form in your early years will shape the rest of your life. Bill Gates once said, "If you are born poor, it's not your mistake, but if you die poor, it's your mistake." Ignoring critical steps now will cost you dearly later. Take charge of your financial future today.

Aakarsh Dalmia can be contacted at 9051355120 or at aakarsh@dalmiafinserv.com