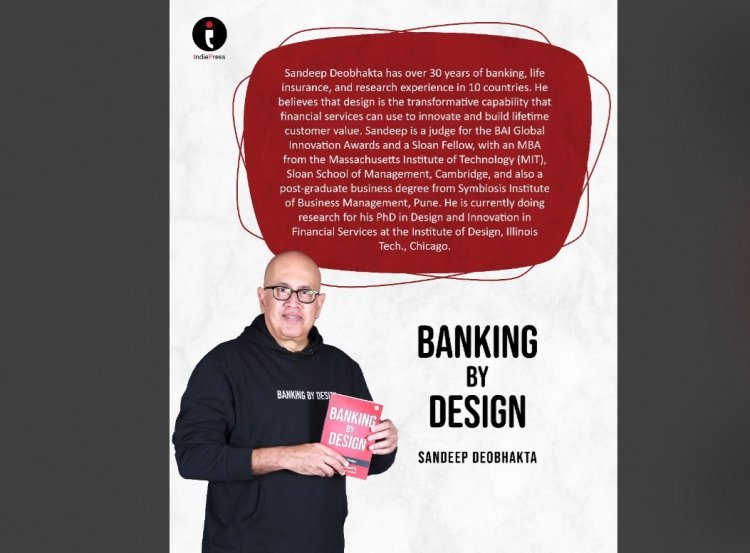

Unlock the Future of Finance: Transform Your Banking Experience with Banking by Design by Author Sandeep Deobhakta

Introduction

In today’s fast-paced financial landscape, innovation and transformation are key to staying ahead. But what if the secret to revolutionizing banking isn’t just technology—it’s design? In Banking by Design, Sandeep Deobhakta explores how Human-Centered Design (HCD) and Human-Centered Artificial Intelligence (HCAI) can reshape banking, insurance, and financial services. By focusing on user experience, problem-solving, and value creation, this book highlights how financial institutions can leverage design principles to build trust, improve accessibility, and drive meaningful change.

1. Could you give a synopsis of your book and the main issues it tackles in the modern world?

Banking by Design argues that financial institutions—banks, insurers, and fintech firms—are often too focused on products and distribution, missing a crucial element: human-centered innovation. The book demonstrates how applying HCD and HCAI can revolutionize financial services by making them more intuitive, efficient, and aligned with customer needs. It presents design not as aesthetics, but as a powerful tool for solving problems, enhancing experiences, and driving transformation in the industry.

2. What specifically qualified or experienced you for this subject area, and what motivated you to write this book?

With years of experience in the financial sector, I have witnessed firsthand how design can be a game changer in banking. This book was born from my belief that design-thinking methods can empower financial institutions to innovate, create value, and build trust with customers. HCD and HCAI play a critical role in banking, ensuring AI-driven solutions are accessible, user-friendly, and relevant. By embracing design-led transformation, financial firms can foster collaboration, boost confidence within teams, and achieve better, more successful outcomes.

3. Could you point to any case studies or practical examples from your book that exemplify the ideas you talk about?

The book presents numerous real-world examples of design-driven success in digital banking. Notable case studies include:

- Nubank (Brazil): One of the world’s most successful digital-only banks, revolutionizing customer experience.

- Ally Bank (USA): A leading example of digital banking innovation.

- Starling Bank (UK): A challenger bank redefining user-friendly financial services.

- Capital One (USA): Using design and AI to transform banking interactions.

- Sony Bank (Japan) & Judo Bank (Australia): Pioneers in applying design thinking to create seamless banking experiences.

Additionally, the book explores the success of payment systems in India, Brazil, and China, highlighting how thoughtful design has shaped modern financial ecosystems.

4. In an ever-evolving world, how does your book continue to be applicable and flexible for readers throughout time?

As technology continues to drive change in finance—from digital banking to AI-powered solutions—design remains more relevant than ever. Unlike trends that come and go, HCD and HCAI principles provide a timeless framework for user-centric innovation. By focusing on how people interact with financial services, design ensures that every wave of technological advancement results in practical, successful transformation.

Ready to revolutionize your banking experience? Get your copy of Banking by Design today on amazon!

SRS Media

SRS Media